More Powerful Personal Online Banking is Coming in May, 2025

As part of our commitment to innovation and continuous improvement, we are upgrading our Personal Online Banking system!

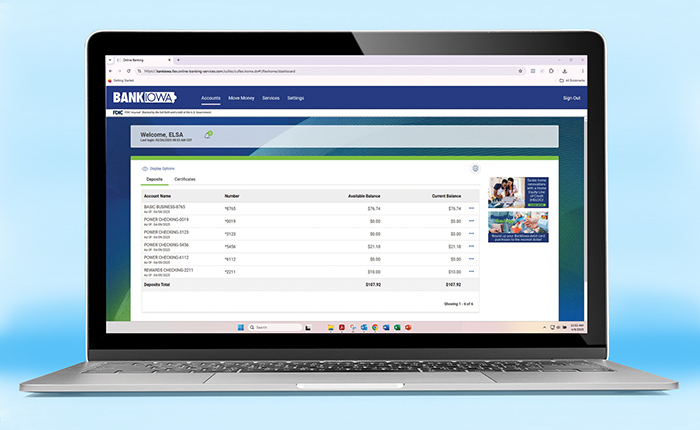

Our Personal Online Banking is getting an upgrade with a fresh, modern user interface that is easier to use. This update streamlines the management of your accounts and improves the navigation, so you can perform transactions and transfers with fewer clicks.

Please note that there is no change to our mobile app. Only online banking is receiving an upgrade.

New Features

Transfers

- Internal Transfers – allows you to transfer funds to deposit accounts or loans internally to a recipient that also has a BankIowa deposit and/or loan account. NOTE - the receiving customer has no access to your account, this is a one-way transfer of funds from you to them.

- Transfer Notes – available for any transfer type, you may add a transfer or payment description note which is then viewable on your account statement

- Transfer Templates – allows you to set up a template for recurring transfer types (ex. if you frequently perform a very similar transfer, such as from Account A to B, but you might vary the amount and when the transfer occurs, you can setup a Transfer Template and edit it easily to accommodate slight variations in transfers)

Alerts

- Account and Service Alerts – offering expanded options for account and service alerts; easier to select alert options for transactions or account activity to send you an alert via your email and/or mobile device, depending on which communication options you choose

Other Enhancements

- Secure Messaging – message our customer care team directly with a question or Request a Service (ex. order checks, change of address, request photocopies, etc.); additionally, secure messaging allows for a document to be attached and sent to our customer service team

- Download Transactions – ability to download account transactions as Quicken (QFX), QuickBooks (QBO), TEXT, and EXCEL file formats compatible with spreadsheet and accounting software

Custom Username – ability to create and save a new username (you are not tied to the original username you selected when first creating your account)

These updates are all about making your experience better—simpler, smoother, and more aligned with how you want to manage your finances.

FAQ

General Information

Who can I reach out to with questions?

You can contact the Customer Contact Center at 800-433-0285 or visit your local branch during normal business hours.

Will I need a new debit card?

No, your debit card will remain the same.

Will I have a new account or routing number?

No, your account and routing number will remain the same.

I currently have eStatements. Will that preference carry over to the new platform?

Yes, if you are currently enrolled to receive eStatements, this selection will carry over to the new online banking platform.

Will my account nicknames be transferred to the new platform?

No, but you are able to set up account nicknames in the new platform.

Will the scheduled transfers I have set up migrate to the new platform?

Yes. Scheduled transfers, including external transfers, are maintained in the migration to the new platform.

Will I still have be able to manage Banking Categories?

No. Banking Categories are going away. We recommend you create a banking report prior to May 9 to preserve your data.

Login

Will I have to change my username and password?

No. Your username and password will remain the same throughout and after the transition. The only exception is if your username contains special characters not allowed by the new system. There’s a small chance you will have to make a slight change to your username since certain special characters are not supported. If this is the case, the system will notify you when you login for the first time after the update.

What steps do I need to take once I log in to the new banking platform?

Once you log in to the upgraded banking platform for the first time, you will need to read through and accept the new Online Banking disclosure. Upon accepting the disclosure, you will be given full access to the new online banking platform and all new features.

Bill Pay

Will my bill pay history, payee settings, and scheduled transfers carry over to the new platform?

Yes, there is not change to bill pay, therefore all of your history, settings, and scheduled transfers carry over to the new platform.

Alerts

I currently receive alerts when new statements or notices are available – will I still receive alerts?

Yes, but your previous alert settings will not automatically transfer. To set up alerts in the new platform, access Settings from the main menu and then select Alerts. From there, you’ll be able to manage your account and service alerts.