Securing Trust: Your Safety, Our Priority at BankIowa

Exercise caution when encountering unfamiliar calls or voicemails concerning your credit or debit card. If you receive a call that raises suspicions, hang up and avoid sharing any information. BankIowa prioritizes your security and will never solicit your personal details without proper identification in our communications. Be vigilant against callers seeking sensitive information and, if uncertain, end the call and contact us directly at 800-433-0285. Discover invaluable insights on Identity Theft and Data Security through our resources to fortify your defenses against prevalent cyber threats affecting both businesses and consumers. Elevate your awareness and resilience to potential fraud by exploring the links below.

Beware of Unidentified Calls or Voicemails About Your Credit or Debit Card

If you receive an unidentified call or voicemail about your credit or debit card that you believe may be fraudulent, hang up immediately. Never provide your credit or debit card to someone who calls you unsolicited or says they represent BankIowa. BankIowa will never contact you to ask for your personal information. Any message from BankIowa will always include identification. Be suspicious of any caller who asks for your personal information, such as your social security number or bank account number. If you’re not sure about the legitimacy of a call, hang up and call us directly at 800-433-0285.

Identity Theft and Data Security Resources

Computer-related crimes affecting businesses and consumers are frequently in the news. While federally insured financial institutions are required to have vigorous information security programs to safeguard financial data, financial institution customers also need to know how to steer clear of fraudsters. Please click the link below for more information.

Learn how to protect yourself and your personal information when traveling.

With stories about Cyber-Attacks in the news daily, it's a good time to refresh your knowledge of the safety and security of your account information, while arming yourself with tested techniques of your own. For more information on account hijacking and identity theft, click on the brochure link below.

Refresh your knowledge in the area of online banking and data security by clicking on the link below. Read about what measures you can take to protect yourself, learn about online and mobile threats, as well as tips on using free credit reports.

Learn about steps you can take as consumers to help your bank provide maximum security for their assets and your good name. By clicking on the link below you can read updated information that covers FACT Act protections and free credit reports.

Be Aware of Website and Email Fraud

- FFIEC Business Account Guidance - Risk Assessment & Layered Security For Online Business Transactions

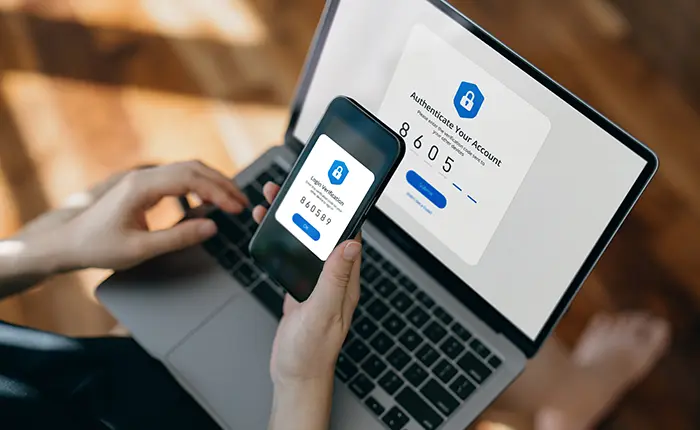

- FFIEC Consumer Guidance - Important Facts About Your Account Authentication & Online Banking

Notice Of Expiration Of The Temporary Full FDIC Insurance Coverage For Noninterest-Bearing Transaction Accounts

By operation of federal law, beginning January 1, 2013, funds deposited in a noninterest-bearing transaction account (including an Interest on Lawyer Trust Account) no longer will receive unlimited deposit insurance coverage by the Federal Deposit Insurance Corporation (FDIC). Beginning January 1, 2013, all of a depositor’s accounts at an insured depository institution, including all noninterest-bearing transaction accounts, will be insured by the FDIC up to the standard maximum deposit insurance amount ($250,000), for each deposit insurance ownership category.

For more information about FDIC insurance coverage of noninterest-bearing transaction accounts, visit:

FDIC Insurance Videos

Click the button below to access informational videos about FDIC Insurance.

Mobile Security

10 Easy Ways to Increase the Security of Your Mobile Device

Smartphone and tablet sales have skyrocketed over the past several years, equipping the majority of consumers with quick access to a massive amount of useful information. For many of those users, this includes sensitive personal information, such as login IDs, passwords, banking account and purchase histories, and social data. Are you taking steps to protect the information on your device from getting into the wrong hands?

Whether or not you choose to use BankIowa Mobile Banking, we encourage you to take steps to protect your information. Here are some simple ways that you can increase the security of your mobile device:

- Set up your security code lock screen. This helps prevent unauthorized individuals from gaining access to your data.

- iPhone: Settings, Passcode, Turn Passcode On. If Simple Passcode is Enabled, you will use a 4-digit number for your passcode. For stronger protection, Disable the Simple Passcode. This allows you to use any combination of letters/numbers/symbols from 5-15 characters long.

- Android: Settings, Lock Screen and Security, Screen Lock Type. Select from a variety of options and security levels.

- Do not reuse your password or passcodes for banking or other apps.

- Set an idle timeout that will automatically lock the phone when not in use to help prevent unauthorized access of your data.

- Only download apps from trusted sources.

- Don’t choose automatic login for banking or other apps that contain your sensitive information. It is an easy way for someone to be able to change your passwords and/or phish for more information to defraud you or your family.

- Only use secure networks to access personal information with your device. Fraudsters often set up in public locations and disguise their network to look like it is owned by a nearby business. When you use their unsecure Wi-Fi, they can gain access to the data you transmit.

- Delete mobile banking text history.

- Use mobile security software. Your mobile devices are not immune, so protect them from viruses just like you would your home computer. Several options are available for free or for purchase. Popular PC/Mac antivirus software companies also offer mobile solutions, so you may want to check first with a company you trust.

- Set up a Location tracker. Several apps are available that allow you to login on a different device to get the GPS coordinates of and/or sound an alarm on your device that has been lost or stolen. A few to try: Find My iPhone by Apple or Lookout for Android.

- Remote wipe if necessary. In the case that your device is lost and you want to keep someone from accessing your information, it may be a good idea to “wipe” that information remotely. A remote wipe service might be available with the security software or location tracker you have selected above. Your mobile provider should also be able to do this at your request.

ERROR RESOLUTION AND INFORMATION REQUEST FOR MORTGAGE LOANS

If you need to request information or report an error in relation to your real-estate secured loan, you must submit your request in writing to: BankIowa, Attn. Loan Operations, 230 1st St East, PO Box 229, Independence, Iowa 50644. Please include your name, loan number, and the information you are requesting or a description of the error you believe has occurred. If you have further questions or would like to reach us by phone, please contact us at 1-800-433-0285.