BankIowa

Updated 9:38 AM CDT, Tue October 15, 2024

Published Under: Credit & Debit

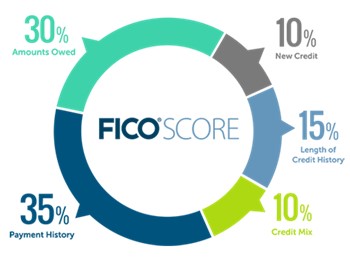

Have you ever wondered what exactly makes up your credit score? Your credit score can be compared to a report card, detailing your financial responsibility. Some factors that determine this score are payment history, credit utilization, length of credit history, types of credit, and new credit. Understanding the different components of your credit score can help you take control of your credit score and improve your financial well-being.

Credit Score Ratings

The two dominant types of credit scoring models are FICO and VantageScore. The scores are calculated similarly but your actual scores may vary based on the scoring model used. Both scoring models use a numerical rating of 300 – 850 to assess a borrower's credit risk.

Credit score ranges for FICO scores are:

- Poor: 300–579

- Fair: 580–669

- Good: 670–739

- Very good: 740–799

- Excellent: 800–850

Your Payment History

The first question to ask when evaluating your credit score is “Have I ever had any late payments?” Having a past due payment can impact your credit score, and the severity of the impact can be based on how late, how long ago, and how many late payments have been made. One singular payment may not have a significant impact on your score if your report is in good shape. If a payment or multiple payments are 60-days or later, your score will plummet. Past bankruptcies, charge-offs, or foreclosures can also harm your credit score. One way to correct the issues is to avoid late payments in the future. Over time, the credit impact of past overdue payments will diminish.

Credit Utilization

Credit utilization is key to keeping your FICO score in decent shape. The “rule of thumb” to credit utilization is keeping your total balance to 30% or below your max credit limit. For example, if you have two credit cards and the total available credit is $18,000, then 30% of that is $5,400. You would want to keep your combined balance with both cards to below $5,400. If you are using a lot of your available credit, this may indicate that you are overextended. Lenders can interpret this to mean that you are at a higher risk of defaulting on loans. Paying down your credit card balance using responsible credit utilization is good for both your credit score and bank account. Coinciding with credit utilization, making larger payments (like mortgage, car, or student loans) in a timely manner, helps your credit score immensely.

Length of Your Credit History

Your credit score does not consider your personal age, but it considers the age of your different accounts. Older accounts tend to gain the most points for a FICO score, particularly if there have been no late payments or fees. Another way to boost your score is by becoming an authorized user for an account that has a good credit history. Examples include an aging parent or spouse. While time is not the magic solution to boosting your credit, it can have long-term benefits. It is also not a good idea to close a credit card if you have had it for many years. That card contributes not only to your available credit, impacting your credit utilization score, but also impacts the length of your total credit history. It may be better to keep the card open even if there is no ongoing need for it.

Understanding what makes up your credit score is a great step towards financial empowerment. By keeping an eye on your payment history, the balance of your accounts, and length of your credit history, you can work towards building a strong credit score. Remember, your credit score reflects your financial health. Taking control of it now can open doors to great opportunities in the future!

Resources:

Forbes

Agatha R 10:39 AM CDT, Mon October 28, 2024Reply

Is there a freeze on my account if so how do I fix this.

Site Admin 9:18 AM CST, Thu November 7, 2024Reply

Please contact us at 800-433-0285 to resolve any issues. Thank You!